Now, the date has been moved up to March 15 to match the due date for S corporations. Tax returns for calendar year partnerships used to be due on the same day as individual tax returns, April 15.

March 15, 2017: Partnership Form 10 calendar year (NOTE: For other partnerships, the return is due on the 15 th day of the 3 rd month following the year end) NOTE: This change only applies to this year. The deadline is March 31 for electronic filing. That deadline is still February 28 if you file by paper. It’s important to note that the deadline for filing related Forms 1094-B, 1094-C, 1095-B and 1095-C with the IRS hasn’t changed. The IRS says taxpayers don’t need to wait to receive these forms before filing. Because of the deadline extension, some taxpayers may receive these forms after they’ve filed their taxes. March 2, 2017: Health Coverage Information Forms 1095-B and 1095-C for recipients Form W-3 is the transmittal form used to submit your W-2s to the IRS/SSA. This change is also designed to help minimize tax fraud and identity theft. Previously, W-2s went to employees by January 31, and the W-3 could go to the IRS/SSA by February 28 if filed on paper or March 31 if filed electronically. The government and employees now all need copies of Forms W-2 by January 31. Form 1096 is the transmittal form used to submit your 1099s to the IRS with. Also worth noting is that Form 1099 can only be issued electronically to the recipients with their consent. So, it’s good to double check what kind of 1099s you’re required to file and when they are due, along with their corresponding Forms 1096. The due date for Forms 1096 is extended until March 31 if you file them electronically. Depending on the type of income being reported, the 1099s are due to the recipient on January 31 or February 15, and Forms 1096 are due to the IRS on February 28. It is important to note that due dates for other Forms 10 haven’t changed. This is due regardless of whether or not you submit the forms to the IRS electronically. Your Forms 1099-MISC are due to the IRS on January 31, if you report non-employee compensation in box 7. The date was changed to minimize tax fraud and identity theft. The old due date for this form was February 28.

2016 TAX EXTENSION DUE DATE FEDERAL DOWNLOAD

For the tax deadlines you need to know that have changed for your 2016 taxes, check out this quick reference list of due dates – or download this Cherry Bekaert chart “Date Changes in the Federal Tax Calendar.” Date Changes in the Federal Tax Calendar January 31, 2017: Certain Forms 1096, if you report non-employee compensation in box 7 of Form 1099-MISC That’s the day when the IRS begins accepting electronic tax returns and processing paper tax returns. Tax season officially starts on January 23, 2017.

This year, some deadlines have changed by as much as a month and a half. But the changes usually affect the deadlines by a matter of a few days.

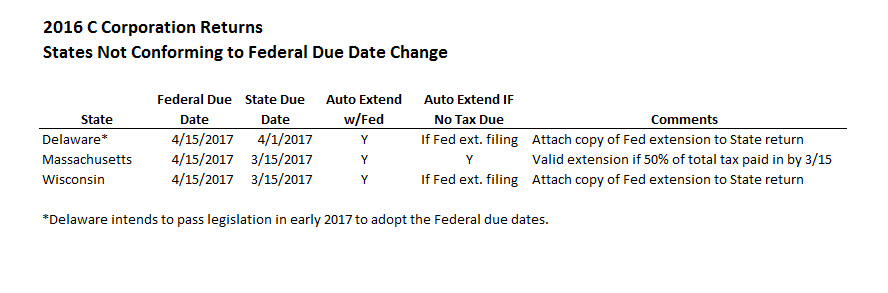

Filing deadlines move around on a regular basis, because of new tax laws, weekends, and holidays including Emancipation Day, which is a legal holiday only in Washington, D.C. And if you don’t know what those changes are, you could unintentionally be late filing a form or making a payment to the Internal Revenue Service (“IRS”).įederal deadlines for filing your personal and business taxes aren’t as permanent as people think they are. To see if your tax return due date has changed, check out the state-by-state quick reference chart of tax return due dates for C corporations that have a December 31 year end from the American Institute of Certified Public Accountants.Ī lot of important tax filing deadlines have changed in 2017, some by as much as a month. Updated as of February 6, 2017: Some states have chosen to change their corporate tax due dates in response to the changes the Federal government has made to its tax due dates. All the links in this article have been updated to reflect the most current chart. Also, AICPA updated their state-by-state quick reference chart in March. The extension period for all other corporations remains unchanged, so that the extended due date of all C corporation returns is the fifteenth day of the tenth month after the year end. Updated as of September 1, 2017: C corporations with a fiscal year ending June 30, 2017, can apply for a seven-month extension.

0 kommentar(er)

0 kommentar(er)